how are property taxes calculated in polk county florida

That amount is taken times the set tax levy the sum of all applicable governmental taxing-empowered units. Current Tax Rate.

How You Can Calculate Property Tax When Buying A Home

Documents can be recorded in-person at any.

. Checks should be made payable to. Polk County Property Appraiser. While Polk County collects a median of 090 of a propertys each year as property tax the actual amount of property tax collected is lower compared to the rest of Florida.

The calculation is based on 160 per thousand with the first 500 being exempt. Bartow Florida 33830. For example if your home has a taxable value of.

Based on average home prices you can anticipate. To calculate the exact amount of property tax you will owe requires your propertys assessed value and the property tax rates based on your propertys address. The average tax rate in Polk County is 09 of assessed home values which is just below the state average of 097.

1932-1939 50 per 500. These are deducted from the assessed value to give the. 255 North Wilson Avenue.

The Tax Collector collects all ad. Taxable Property Value of 75000 1000 75 75 x 72 mills 540 in City Taxes Due The Tax Collector collects all ad valorem taxes levied in Polk County. Please note that we can.

Our Polk County Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax. The current market worth of real property located in your city is calculated by county assessors. Polk County Clerk of Court.

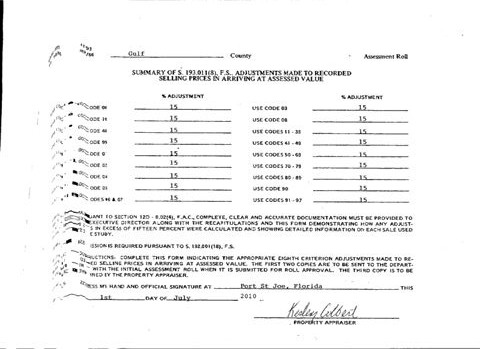

863 534 4753 Phone The Polk County Tax Assessors Office is located in Bartow Florida. 1940-1967 55 per 500 1st. The appraisal of property is performed by the Property Appraiser who is responsible for determining the value of your property including exemptions.

Once you know your homes taxable value you can multiply it by your countys tax rate to calculate your property taxes. Florida provides taxpayers with a variety of exemptions that may lower propertys tax bill. To confirm your calculation call Polk County Recording at 863-534-4000 option 7.

The state also enacted guidelines that county administrators are required to conform to in. An appraiser from the countys office estimates your propertys market value.

Broward County Fl Property Tax Search And Records Propertyshark

Florida S 50 Largest Cities And Towns Ranked For Local Taxes Kiplinger

Volusia County Fl Property Tax Search And Records Propertyshark

Polk County Property Appraiser Richr

Florida Dept Of Revenue Property Tax Data Portal

Florida Property Tax Calculator Smartasset

Property Taxes Polk County Tax Collector

Polk County Fl Property Tax Getjerry Com

2022 Legislative Priorities Winter Haven Chamber Of Commerce Winter Haven Fl

How To Register For Florida S Sales Use Tax

Florida Dept Of Revenue Property Tax Data Portal

Florida Intangible Tax And Transfer Tax How Do You Calculate These Closing Costs Usda Loan Pro

Polk County Fl Property Search Interactive Gis Map

What Is Florida County Tangible Personal Property Tax

Hillsborough County Property Taxes 2022 Ultimate Guide What You Need To Know Rates Search Payments Dates

Property Tax Estimator Tools By County

Polk County Fl Real Estate Polk County Fl Homes For Sale Zillow